INTRODUCTION

A well-designed Sales Incentive Plan (SIP) can help companies attain aspirational growth targets and other key sales objectives desired by leadership. However, to the contrary, a poorly designed plan can result in stagnant sales and high turnover in top rainmakers. In this article, we will discuss numerous levers that can be pulled when designing a SIP, and additional spiffs that can be layered in to achieve the desired outcome. While stitching all these components together can be complex – especially when trying to maintain a healthy profit margin – the result needs to be simple enough for sales reps to easily understand and execute.

ALIGNMENT WITH MANAGEMENT OBJECTIVES

The first step in designing a new SIP is to align the structure of the plan with leadership objectives. Commonly in the SaaS industry, many companies are targeting ARR growth, both in volume and as a percentage of revenue, to establish a consistent revenue stream and achieve an increased valuation in the market. In a recently published research article from SaaS Capital1, public companies are achieving ~17x multiples on ARR while private companies are achieving ~12x multiples. Other objectives may be considered, such as new logo growth or increasing average contract length (ACL), but it is important to keep the underlying objective of the plan simple and easy to understand.

ESTABLISHING CLEAR ROLES AND RESPONSIBILITIES

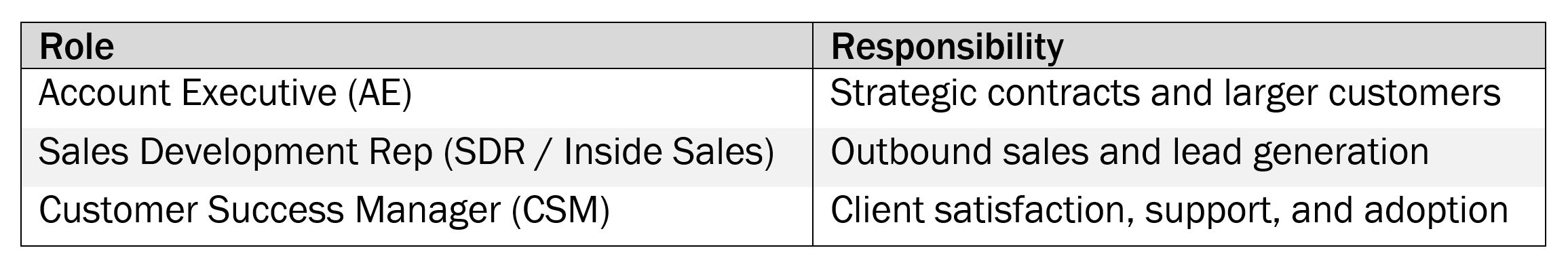

Once you have defined objectives, establishing standard roles and responsibilities is key to effectuating growth. To avoid complexity within the sales organization, we find it beneficial to start with a few building block positions and expand roles as the business grows. Core roles to any sales department are:

As the business scales, you can introduce junior or senior titles, such as Senior Account Executive or Enterprise Account Executive, who would be responsible for larger accounts and strategic contracts. Clear responsibilities for each of these roles is vital and additional consideration should be given to a threshold for key accounts, which role handles renewals to ensure a sale centric personality is involved, and the transition of leads to AE’s. Once your roles and responsibilities are decided, you should align a compensation structure to match and establish key variable drivers for commission.

DESIGN WIN-WIN SALES COMPENSATION

When designing a compensation structure simplicity is essential for sales representatives to understand how, when, and how much they will be paid. Adhering to a simple SIP design will also enable higher levels of automation on the backend reducing administrative burden and increasing accuracy in payout calculations.

HOW

Total compensation for a sales representative is referred to as OTE (On-Target Earnings) and consists of two components: base and variable (OTI) pay. Within the fast-paced, rapid-growth SaaS industry, it is most common for Account Executive’s to split the two components 50/50 between base and variable; however, successful reps may negotiate up to a 60/40 split. Customer Success Managers (CSM’s) have differing objectives and are therefore typically compensated on a 90/10 basis, which is less leveraged than outbound sales. The variable, or commission, portion of each role should be tied to an underlying KPI related to respective activities. Account Executives for example must drive ARR growth through new logos, expansion, and renewal contracts. Customer Success Manager’s commission on the other hand should be linked to customer retention or churn inversely.

The ratios of base-to-variable mentioned above are common observations, but each company may tweak these percentages depending on multiple factors. If there is a mature market for your products which is high volume, then the mix might shift to 25/75. Conversely, if your company has longer sales cycles and complex implementations, then reps should be compensated with a higher base salary percentage.

WHEN

The first decision, with regard to timing, should be choosing between bookings or upon cash receipt. While cash receipt can be an appealing option for businesses that do not have excess reserves or strong working capital, it adds layers of complexity to the process. Instead, payment based on bookings will not only keep the admin work to a minimum but will also keep the sales reps happy. To help mitigate the potential cash drain on the business, a clawback can be implemented for deals that fail to close and commission payments can be disbursed on a quarterly basis. Quarterly disbursements may sound difficult for sales reps to manage; however, we often find material contracts are signed towards the end of a quarter and the actual hold on commission payouts is far less than it appears. A draw can be introduced to help immediate cash needs in the transition on an as-needed basis.

HOW MUCH

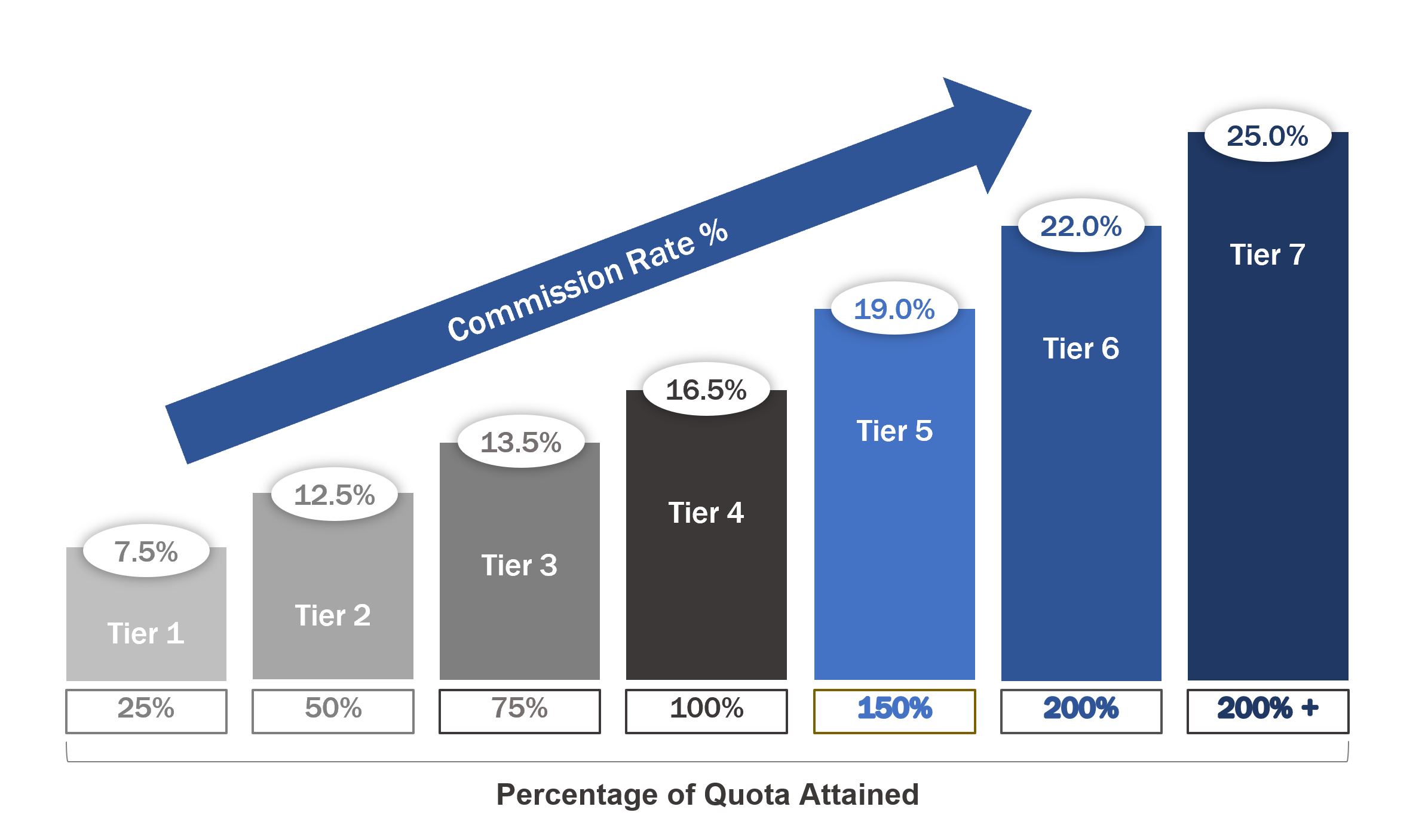

While the sales plan needs to be easy to understand, it also needs to be beneficial for both the sales representative and the company. To achieve this balancing act, we find a tiered commission structure to be the most effective. The tiered structure entails an increasing commission rate as each tier is filled by the rep, reaching closer to their quota. In the table below, we have laid out a common AE base commission rate of 12.5% derived from a quota of $800K and an OTI of $100K. In this scenario, the first $200K (25% of quota) would be paid out at a 7.5% commission rate and accelerates in excess of the standard 12.5% rate as the rep reaches quota attainment.

Using this approach, sales representatives who are high performers will be rewarded while underperformers will be penalized by the lower commission rates in the earlier tiers. High performers are also encouraged by no-cap commissions and the rate continues to accelerate beyond 100% attainment of their quota. In totality, it is more cost effective to reward your outperformers than to hire or maintain additional lower performing sales reps.

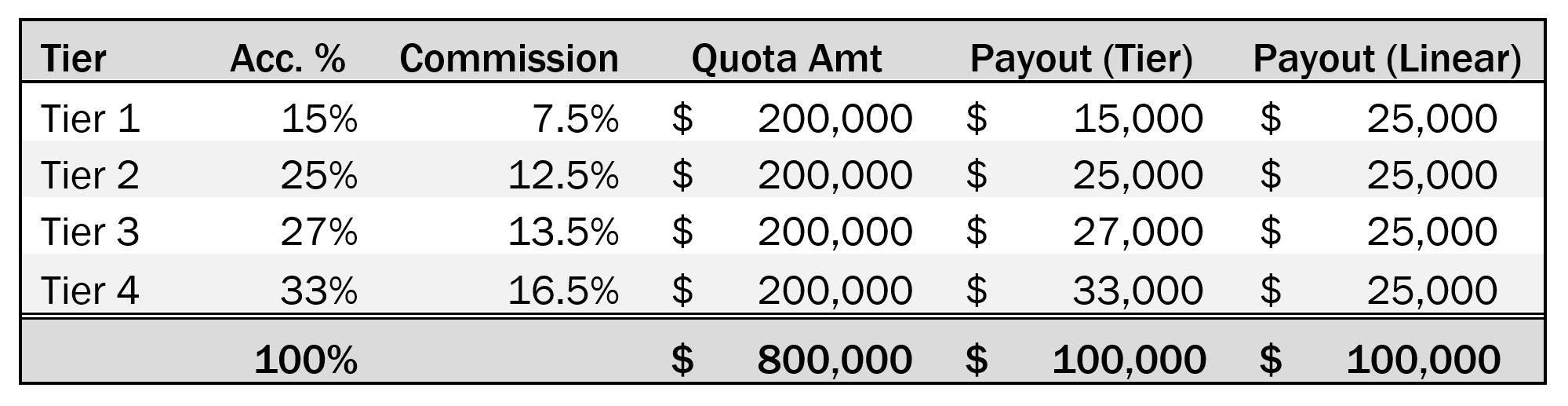

The following table demonstrates the advantage of a tiered system using the assumptions from the previous scenario (OTI $100,000; Quota $800,000):

As you can see, if a sales rep only attains 50% of their quota, OTI payout will be $10K less than in a linear commission structure. Accelerator percentages may be tweaked to increase or decrease the impact to OTI, but the outcome should remain where underperformers are compensated less if they do not achieve their targets.

SETTING QUOTAS

In most cases, businesses will set aggressive bookings targets hoping to grow the topline at a favorable CAGR. This can result in discrepancies between what is achievable with the current sales staff and the aspirations of management. One approach to setting an attainable plan is to start with a top-down bookings target and add a safety net of 15-20%. From there, shift to a bottoms-up view by setting quotas for existing reps. An industry rule of thumb for setting quotas is 4-6X OTE, so if an AE has an OTE of $200K their quota should be at or above $800K. Historical analysis of quota attainment and forward-looking market analysis can help set the boundaries to what is realistic. Finally, take the summation of quotas and compare it to the bookings target. If the gap is minimal, stretch quotas can be issued, otherwise simple math can be used to determine the number of new reps to be hired to achieve the desired growth. Keep in mind there is a ramp period for each rep from the hiring process to their first sale which is at a minimum of 3 months, so quotas should be discounted accordingly.

CONCLUSION

An effective Sales Incentive Plan can be the difference between a company struggling to keep up with their growth or a stagnant to deflationary business environment. The sales plan needs to adhere to management objectives while profitably incentivizing sales staff to reach their targets. Crafting such a plan to strike this balance while keeping it straightforward is not always easy; reach out to us at SLKone to learn how we can help you develop a successful Sales Incentive Plan and automate backend commission calculations to reduce admin hours while improving accuracy.

1SaaS Capital; 2021 Private Company Valuations

Download this Article as a PDF